do nonprofits pay taxes in canada

There are differences between these types of organizations. All nonprofits are exempt from federal corporate income taxes.

2022 Canada Federal Budget Detailed Commentary Fletcher Mudryk Llp Chartered Professional Accountants Grande Prairie Ab

An NPO cannot be a charity as defined in the Income Tax Act.

. Do Churches In Canada Pay Taxes. But nonprofits still have to pay employment taxes on behalf of their employees and withhold payroll taxes in accordance with the information submitted on their W4 just like any other employer. GSTHST Information for Non-Profit Organizations.

There are many variations in the requirement for nonprofits to file tax returns based on certain elements such as type of business and financial status. This exemption applies only to income tax. Under the Act a charity can apply to the Canada Revenue Agency for registration.

Yes nonprofits must pay federal and state payroll taxes. Not-for-profits generally do not pay corporate income tax or file an Ontario corporate tax return but they do have to meet some requirements under Canadas Income Tax Act. Do nonprofits pay payroll taxes.

Once accepted a registered charity is exempt from income tax under paragraph 1491f. NPOs do not have to pay taxes but they may have to submit Form T1044 Non-Profit Organization Information Return. In many cases nonprofit organizations and charities do not pay income tax.

Non-profit organizations are exempt from tax under Part 1 of the Income Tax Act for the portion of their fiscal period where they meet the requirements to qualify as a non-profit organization. Charities and not-for-profits ought to ask themselves whether property taxes apply to them in light of this. In Paragraph 1491f a registered.

Nonprofits are of course not exempt from withholding payroll taxes for employees and they also are required to pay taxes on income from activities that are unrelated to their mission. Although nonprofit organizations in Canada do not have to pay income taxes they do have to submit their tax returns with the Canada Revenue Agency. Your recognition as a 501c3 organization exempts you from federal income tax.

Our publications and personalized correspondence are available in braille large print e-text or MP3 for those who have a visual impairment. If your NPO has received or is eligible to receive taxable dividends interest rent or royalties worth more than 10000 you. There are many variations in the requirement for nonprofits to file tax returns based on certain elements such as type of business and financial status.

Because nonprofits are tax exempt homeowners and for-profit businesses are taxed as if they are helping them provide nonprofit organizations with benefits such as streetlights and police. Yes nonprofits must pay federal and state payroll taxes. Find more information at About alternate format or by calling 1-800-959-5525.

Not-for-profits that are registered charities must file an income statement annually to the Canada Revenue Agency. Instead of filing a tax return under the Income Tax Act non-profit organizations must file the Form T1044. Most are also exempt from state and local property and sales taxes.

Distinguishing a non-profit organization from a charity. It is not necessary to pay property taxes to get nonprofit services from local governments. Canada Revenue Agency issues an annual return in order for nonprofits to file.

In fact both organizations are forbidden by the CRA to benefit their members in the same way. Neither exempt from income tax nor from property tax under the Income Tax Act Canada contrary to what appears to be the intention charitable and non-profit organizations often face heavy financial penalties associated with property taxes. Your recognition as a 501c3 organization exempts you from federal income tax.

Our publications and personalized correspondence are available in braille large print e-text or MP3 for those who have a visual impairment. Nonprofit organizations are distinguished from charities by the Act whereas corporations are allowed to seek Registration with Canada Revenue Agency. A Canadian nonprofit would not need to pay income tax but they have to use the Canada Revenue Agency in filing their returns.

Do Nonprofits Have To File Tax Returns In Canada. Are Nonprofit Organizations Tax-Exempt In Canada. Do Not For Profits Pay Taxes In Canada.

A Canadian nonprofit would not need to pay income tax but they have to use the Canada Revenue Agency in filing their returns. In accordance with the type of nonprofit organization the value of its assets and other factors nonprofit organizations must file. These organizations dont have to pay income tax.

A Canadian nonprofit would not need to pay income tax but they have. There are a number of factors that make a nonprofit a more difficult-to-file organization.

Simple Ways To Start A Nonprofit In Canada With Pictures

Simple Ways To Start A Nonprofit In Canada With Pictures

Infographic On Charitable Giving In Canada From Imagine Canada Http Www Imaginecanada Ca Node 802 Infographic N Charitable Giving Infographic Charitable

Cross Border Charitable Activities Hodgson Russ Llp

Simple Ways To Start A Nonprofit In Canada With Pictures

![]()

5 Steps To Prepare Your Business For Tax Season In Canada

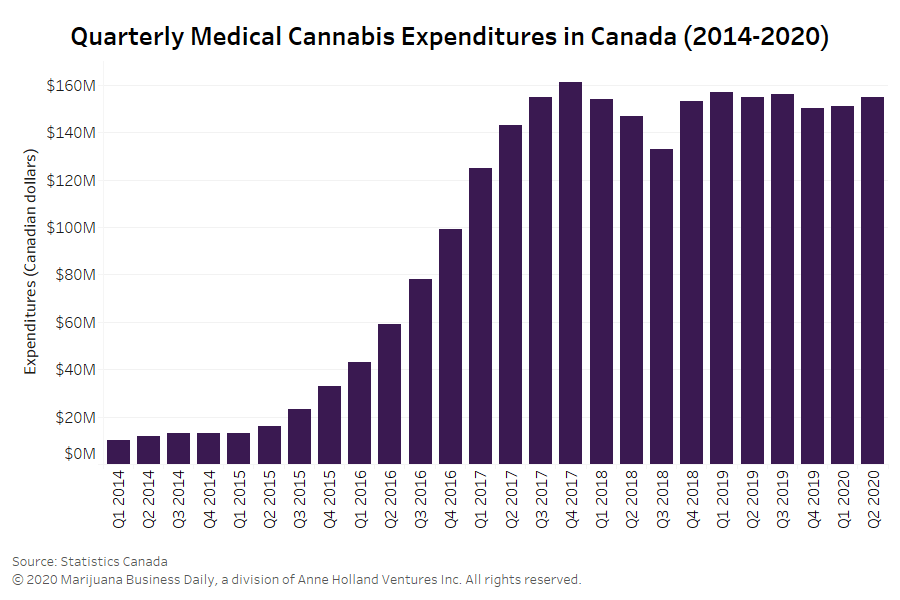

Access Barriers Stall Canadian Medical Cannabis Market Survey Shows

What A National 15 Minimum Wage Actually Means In Your State Mark J Perry Map States Cost Of Living

Canada Distribution Of Donors By Income Level 2019 Statista

How To Register Your U S Company In Canada Naming Rules

Canadian Nonprofits Make Tax Receipts Compliant With Canada Revenue Agency S Regulations Nonprofit Blog

Cross Border Charitable Activities Hodgson Russ Llp

![]()

Canadian Tax Requirements For Nonprofits Charitable Organizations

Google Trends Show Personal Finances Are A Top Priority For Canadians In 2022

Rules Of Engagement The Nonprofit Vote